Tuesday, November 4, 2025

Thursday, August 22, 2024

Thursday, June 20, 2024

Thursday, June 13, 2024

Wednesday, June 12, 2024

Monday, March 4, 2024

Saturday, January 13, 2024

Thursday, November 16, 2023

Sunday, June 4, 2023

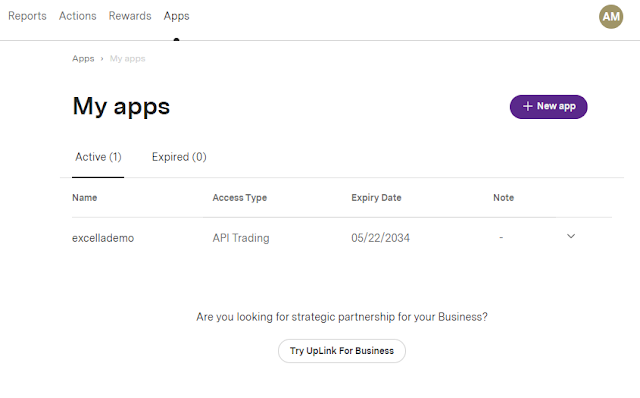

New technical analysis software

Stock market Traders and Investor Tools for Just Rs.500/Month

How does this benefit a trader ?

Reduces the efforts and time spent on analyzing and choosing the best shares for day trading.

Excella trader is useful for traders who primarily watch momentum and looking for short term gains.

Data is absolutely free and can be downloaded from our server.

Traders can get an idea of buying and selling before the market starts.Excella trader automatically generate the result and thus traders can get entry, exit and stop loss levels .

Excella trade tries to avoid fake break outs by its strict screening process.

If indices are not moving on either side there will still be some shares moving, Excella trader captures those shares and gives excellent results.

Key features:

· Dynamic trading systems supported by sophisticated analysis methods

· 10 unique systems developed by Excella trader used to screen and filter shares.

· Excella trader automatically generates recommendations for the day.

· Traders only need to execute the calls.

· Excella trader finds Nifty futures trading levels.· Portfolio management section incorporates portfolio positions, analytic and risk

· Option strategies enable investors to find best strategies for the given period.

· System can be upgraded through the website time to time (free of cost)

· Dedicated after sales service team help traders to clarify their queries

Tuesday, May 23, 2023

Sunday, January 23, 2022

Risk Profiling and suitability assessment

Risk Profiling and suitability assessment

How to Excella software for risk profiling?

Excella is providing tools to financial planners and investment advisors. Excella advanced financial planning software helps an advisor to do all kinds of financial analysis, Goal Tracking , Risk profiling, Goal Planning, Re balancing , Scenario analysis etc.Analysis of portfolio involves all assets like stocks, Bonds, Commodities, Indexes, derivatives etc. So this involves a lot of historical data gathering done through an advanced system.

Maintaining of records

- KYC records of the client

- Risk profiling and risk assessment of the client

- Suitability assessment of the advice being provided

- Copies of agreements with clients

- Investment advice provided, whether written or oral

- Rationale for arriving at investment advice

- Register or record containing a list of the clients

- The date of advice and nature of the advice

- The products/securities in which advice was rendered and fee, if any charged for such advice.

Thursday, June 24, 2021

Software for SEBI registered brokers

EXCELLA

SHARE BROKER’S BACK END SOLUTION

Excella is an advanced web based software for NSE and BSE members.

All back office accounting , SEBI compliances ,

Settlement and Billing process .

Software can easily manage your daily accounting and reporting functions.

All regulatory changes will be immediately implemented

Analysis utility tools to Brokers

1. Derivatives strategy finder

Key Features

· Derivative strategy finder

· Black Scholes calculator

· What if analysis

· 72 in built strategies

· Multiple leg option positions

· Trend finder to get trend swings

· Create own strategies

· Trading simulator

· Option portfolio generator

· Easy to use user friendly method

Benefits

Excella option strategy finder is a powerful analysis tool for development, testing, and application of stock and options strategies. It’s easy-to-use interface allows you to test new strategies, manage a growing portfolio, and explore "what-if" scenarios with ease. Excella options versatility and power make it suitable for new, experienced, or advanced traders alike.

2. Technical analysis utility

Key features:

· Dynamic trading systems supported by sophisticated analysis methods

· Can add different technical indicators to filter the stocks

· Trader can fix technical parameters to filter the stocks

· Automatically generates recommendations for the day.

· Entry , exit stop loss level will be generated

· System will show the intraday trading results and saved it separate file

· Trader can use bulk order utility to pass the orders together to the trading terminal

· Futures trading levels with different technical parameters

· Portfolio management section incorporates portfolio positions, analytic and risk

Benefits

This is useful for intraday traders. Useful for making bulk order

3. Fundamental analysis tool / DCF calculators

Features

· Fundamental Screeners: Stock Screeners by Fundamental parameters - choose any parameter in the drop down to see stocks where metric is the highest or lowest. Sort by net profit growth, revenue growth, PE averages and more. These are editable screeners.

· DCF Analysis screens: This will be useful for finding the fair value of s stock with given parameters

· Quarterly result analysis : This will be useful for traders who making decision based on the quarterly results

· Ratio analysis

· Growth analysis

Benefits

Useful for long term traders to build their portfolio

4. Portfolio Optimisation Tool

Features

· Portfolio Optimization: Optimize portfolios based on mean-variance, Value-at-risk (CVaR), risk-return ratios, or drawdowns.

· Historical Efficient Frontier

· Forecasted Efficient Frontier

· Portfolio Optimization

· Monte Carlo Simulation

· Financial Goals

· Asset Liability Modeling

Back test Portfolio: Back test a portfolio asset allocation and compare historical and realized returns and risk characteristics against various portfolios.

· Backtest Asset Allocation

· Backtest Portfolio

· Backtest Dynamic Allocation

Benefits

This tool is use for portfolio managers and advanced investors to build strong stock portfolio and with reduced risk

Wednesday, June 3, 2020

Nifty recovery

Nifty recovered from the low of 7600 and now trading above 10,000. This all happened in locked down period.

If you are an advisory giving tips to clients and managing their portfolios then subscribe excella trader for reporting . This is a web based solution and will help you in day to day performance analysis

Sunday, July 21, 2019

Excella Technical Analysis Software for day traders

Buy Excella Advisory Software

| FEATURES | ||||||||||||

| CLIENT MANAGEMENT | ||||||||||||

| ► Client profiling/ Client data entry | ||||||||||||

| ► Family portfolios / Goal based Portfolios | ||||||||||||

| ► Importing client database from excel / Importing existing portfolios | ||||||||||||

| AUTO UPDATING | ||||||||||||

| ► Market prices and NAV of MF schemes | ||||||||||||

| ► Corporate actions -(Bonus/Split/Dividend/ Name Changes/ FCD conversion Etc) | ||||||||||||

| MULTIPLE ASSETS | ||||||||||||

| ► All asset classes -Equity/ Mutual Funds | ||||||||||||

| ► Alternative investment Funds | ||||||||||||

| ► Assets classified into debt, equity and commodity | ||||||||||||

| ► Real estate / property | ||||||||||||

| ► AIF/ PMS / PE funds / Derivatives etc. | ||||||||||||

| FEES MANAGEMENT | ||||||||||||

| ► Performance based fees setting | ||||||||||||

| ► Hurdle rate based fee setting | ||||||||||||

| ► Daily average portfolio value based | ||||||||||||

| ► Fixed fee setting | ||||||||||||

| ► Fees for different asset classes | ||||||||||||

| TRANSACTION FILE IMPORTING | ||||||||||||

| ► Import file in different formats | ||||||||||||

| ► Brokers contract notes | ||||||||||||

| ► Re balancing | ||||||||||||

| ► KARVY/CAMS statements | ||||||||||||

| ► Franklin/ Sundaram files | ||||||||||||

| ► Other formats in excel | ||||||||||||

| AUTOMATED MAILING | ||||||||||||

| ► Schedule periodical report | ||||||||||||

| ► Sending report automatically to client’s email id | ||||||||||||

| REPORTS | ||||||||||||

| ► Consolidated portfolio report | ||||||||||||

| ►MIS reports / Portfolio analysis report with Alpha and Beta | ||||||||||||

| ► Periodical reports / Quarterly & Monthly | ||||||||||||

| ► Asset allocation report | ||||||||||||

| ► Holding and realized report | ||||||||||||

| ► XIRR report(category/client wise) | ||||||||||||

| ► Transaction summary | ||||||||||||

| ► Account statement | ||||||||||||

| ► Corporate action report | ||||||||||||

| ► Fees payment report / Fees Due report | ||||||||||||

| ► Capital gain reports - | ||||||||||||

| ► Expense report - Fees / Brokerage / Taxes | ||||||||||||

| ► Balance sheet and Profit & Loss account | ||||||||||||

| ACCOUNTING | ||||||||||||

| ► Complete accounting entries for transaction | ||||||||||||

| ► Balance sheet and Profit and loss account | ||||||||||||

| ► Ledgers and party accounts | ||||||||||||

► Reconciliation

| ||||||||||||

| WEB PORTAL( Available with Annual Subscription Only) | ||||||||||||

| ► Advisory dash board | ||||||||||||

| ► Client login facility | ||||||||||||

| ► Client dash board | ||||||||||||

| ► Online fees payment system | ||||||||||||

| ► Document vault | ||||||||||||

| ► Error management system | ||||||||||||

| ► Technical charting | ||||||||||||

| ►Analyst recommendation module |

2ND FLOOR PRESTIGE CENTER

NEAR REGISTRAR OFFICE

KANNUR -670002,KERALA, INDIA

Phone :- +91 497-2762811 / +91 497-2762823